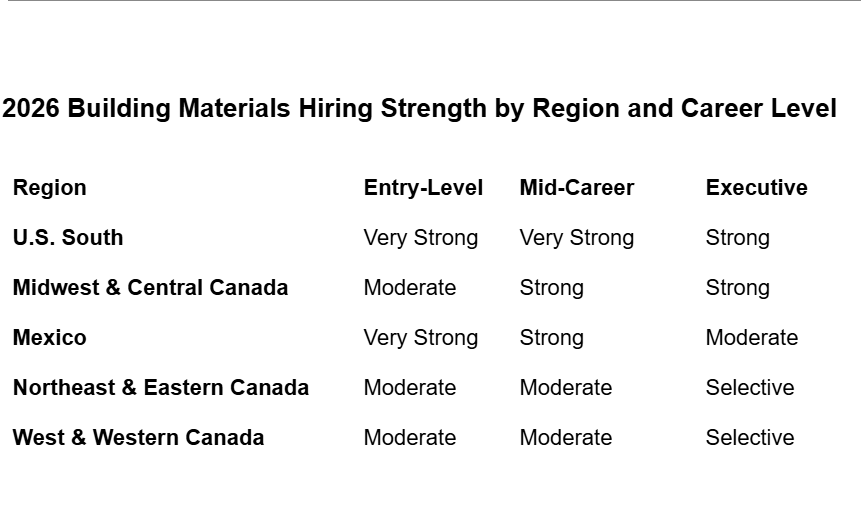

Regional winners, slow zones, and surprise hotspots for plant, sales, and leadership roles.

Table of Contents

- Why Building Materials Will Still Be Hiring

- The U.S. South: High-Volume Hiring Across All Levels

- Midwest & Central Canada: Manufacturing Depth, Leadership Gaps

- Mexico: Near-Shoring's Expansion Engine

- Northeast & Eastern Canada: Selective, Specialized Growth

- West & Western Canada: Premium Markets, Premium Requirements

- The Mid-Career Bottleneck Nobody's Solving

- How to Actually Use This Map

- FAQ

Why Building Materials Will Still Be Hiring in 2026

The building materials industry faces a straightforward paradox in 2026. Construction activity is measured, not explosive. Economic growth is cautious. Yet according to Deloitte's 2026 Engineering & Construction Industry Outlook, the sector needs approximately 499,000 additional workers just to maintain current timelines. Manufacturing faces similar gaps, with positions at risk of going unfilled if skills shortages persist.

The math is simple. Demand remains robust enough to sustain hiring. The supply of qualified workers doesn't meet it. And critically, this imbalance distributes unevenly across North America.

A production supervisor role in North Carolina exists in a fundamentally different labor market than the same position in Ontario. Entry-level warehouse work in Texas faces different hiring realities than in British Columbia. Understanding these regional distinctions, who's hiring, where, and at what career level, isn't supplementary information. It's become essential navigation for job seekers.

What follows maps where building materials hiring will concentrate in 2026, organized by geography and grounded in manufacturing projections, construction forecasts, and hiring surveys from sources including Deloitte, Hays, and industry associations. This isn't speculation about the future. It's pattern recognition drawn from the best available workforce data.

The U.S. South: High-Volume Hiring Across All Levels

The U.S. South (from Texas through the Carolinas, Georgia to Tennessee, Florida to Alabama) doesn't just lead 2026 building materials hiring. It dominates. Population growth, industrial expansion, logistics infrastructure, and construction activity combine with manufacturing tax incentives to create persistent demand across all career levels.

Manufacturing workforce data consistently shows the South accounting for the largest share of U.S. job openings in durable goods. Construction forecasts point to continued Sun Belt activity. Corporate site selection announcements for new plants disproportionately name Southern states.

Entry-level hiring runs hot and continuous. Distribution centers serving growing building markets need warehouse workers, material handlers, and inside sales support. Truss plants, insulation facilities, and component manufacturers hire production associates and quality inspectors to staff new capacity and expanded shifts. For job seekers without extensive experience, the South offers both volume opportunities and employer willingness to train.

Mid-career roles face the tightest competition. Territory sales managers who can navigate dealer networks across multi-state regions. Production supervisors who can run shifts at window plants or component operations. Supply chain coordinators managing complex distribution across growing metros. These positions require 5-15 years of industry experience, expertise you can't develop in six months, and the South's expansion creates acute demand.

According to Hays' manufacturing insights, supervisory and technical roles represent the hardest positions to fill across North American manufacturing. In the South's building materials sector, this translates to elevated compensation, aggressive recruiting, and faster advancement paths than mature markets offer.

Executive searches focus on growth leadership. Regional vice presidents overseeing multi-state territories. Plant directors for new facilities. Operations executives who can scale distribution networks and manage rapid expansion. These roles reward operational execution and the ability to build systems that support growth rather than pure strategic sophistication.

Target metros showing particular strength: the Texas Triangle (Dallas-Houston-San Antonio-Austin), the Carolinas I-85 corridor, Atlanta's manufacturing belt, Tennessee's industrial regions, and Florida's population growth markets.

Midwest & Central Canada: Manufacturing Depth, Leadership Gaps

The Midwest and Central Canada (Michigan through Ohio, Indiana through Illinois, Ontario through Quebec) represent North America's manufacturing backbone. Deep industrial infrastructure, skilled workforce traditions, and significant building materials production capacity in windows, insulation, roofing, engineered wood, and metal components.

The challenge: persistent worker scarcity in regions built for manufacturing. Deloitte's 2026 Manufacturing Industry Predictions explicitly highlights geographic labor constraints, noting that even modest reshoring initiatives drive capacity expansion in areas struggling to find sufficient workers. The Midwest and Central Canada exemplify this pattern.

Entry-level hiring remains active but increasingly sophisticated. Plants can't post "now hiring" and expect applications. Instead, companies must build partnerships with technical colleges, create apprenticeships, offer signing bonuses, and invest in multi-month training programs. For candidates, this means accessible opportunities if you demonstrate aptitude and reliability, employers will be forced by market pressures to develop the rest.

Mid-career positions represent the critical bottleneck. Production supervisors, maintenance technicians, logistics planners, and quality specialists with 5-15 years of floor experience. These roles keep plants running, distribution flowing, and products meeting specifications. The shortage isn't theoretical, it's operational. Facilities run below capacity because they can't staff shifts. Expansions delay because supervisors can't be found.

For job seekers with relevant mid-career experience, this creates leverage: premium wages, relocation assistance, retention bonuses, and customized roles to land the right candidate.

Executive hiring emphasizes operational excellence and multi-site leadership. Plant managers with experience running multiple facilities. Heads of operations who can drive productivity in mature plants. Regional leaders who maintain long-established dealer relationships and navigate stable-to-declining demand. These markets reward process discipline, continuous improvement, and the leadership skills to retain talent in competitive environments.

Focus on Ontario's Toronto-Hamilton corridor, Michigan, Ohio, Indiana, Illinois, and Quebec for the deepest concentration of building materials manufacturing and distribution infrastructure.

Mexico: Near-Shoring's Expansion Engine

Mexico's building materials role has transformed from lower-cost manufacturing option to strategic North American supply chain hub. Near-shoring—moving production from Asia to reduce supply chain risk and shorten lead times—accelerates expansion in component manufacturing, systems assembly, and materials production serving U.S. and Canadian construction.

Entry-level hiring approaches U.S. South volume, concentrated in production. Production operators in plants making windows, HVAC equipment, and building components. Quality inspectors ensuring products meet North American codes. Warehouse workers managing export-oriented logistics. These facilities often run multiple shifts and hire in meaningful volume to support capacity expansion.

Mid-career demand reflects increasing operational sophistication. Manufacturing engineers optimizing production for demanding export markets. Maintenance technicians keeping 24/7 operations running. Quality and compliance specialists navigating both Mexican production capabilities and U.S./Canadian regulatory requirements. Supply chain managers coordinating cross-border logistics, customs, and just-in-time delivery across time zones.

Many of these roles require bilingual capability and cultural bridge-building between Mexican operations and North American parent companies, making them challenging to fill and driving competitive compensation.

Executive hiring focuses on multinational operations leadership. Plant directors with P&L responsibility for significant facilities. Operations vice presidents managing multiple plants or coordinating Mexican manufacturing with U.S./Canadian operations. Supply chain executives designing distribution networks across borders. These positions typically report to North American parent companies and require executives who navigate both Mexican business culture and corporate environments.

Target northern border states (Nuevo León, Chihuahua, Coahuila) with proximity to U.S. markets, the Bajío region (Guanajuato, Querétaro, Aguascalientes) with growing manufacturing clusters, and operations near Pacific ports for products incorporating Asian components.

Northeast & Eastern Canada: Selective, Specialized Growth

The Northeast U.S. and Eastern Canada share mature, sophisticated markets with established distribution networks, deep technical expertise, and slower population growth than Sun Belt regions. Manufacturing concentrates in higher-complexity, higher-value products: architectural glass, high-performance envelopes, specialized HVAC equipment.

Entry-level opportunities remain steady in inside sales, customer support, and smaller manufacturing facilities. Growth rates trail the South and Mexico, making positions more competitive. The advantage: established companies with longer tenure patterns and developed training programs.

Mid-career hiring shows relative strength in technical depth. Technical sales representatives who can specify glazing systems or estimate mechanical equipment. Estimators and project coordinators for complex commercial construction. Branch and plant supervisors in facilities producing windows, doors, or specialized components. These roles require product expertise that takes years to develop, making lateral hires difficult and creating sustained demand for experienced professionals.

Executive searches skew toward replacement and consolidation. Regional general managers, plant directors, and senior sales leaders changing roles through retirement or M&A integration. Selective, relationship-driven searches favoring candidates with established industry networks and proven track records in mature markets.

For job seekers targeting these regions: emphasize specialized knowledge and technical capability. Look for employers in architectural products, high-performance systems, and commercial distribution. Recognize that relationship networks matter—these markets reward time invested in industry associations and cross-company connections.

West & Western Canada: Premium Markets, Premium Requirements

The West (Pacific Coast, Mountain states, British Columbia through Alberta) presents the most varied hiring landscape. Coastal markets combine high living costs with sophisticated building products: architectural glass, advanced HVAC, high-performance envelopes, smart building technologies. Interior markets show more conventional dynamics but variable construction activity.

The unifying thread: selectivity across all career levels.

Entry-level hiring tracks construction cycles more closely than other regions. When residential construction slows, warehouse and distribution roles contract. When commercial and infrastructure projects accelerate, specialty manufacturing expands. For 2026, signals are mixed, cooling in some residential markets, sustained activity in commercial and infrastructure.

Mid-career demand concentrates in technical specialization. Technical sales for complex building systems. Project managers in commercial distribution. Production specialists in high-value manufacturing. Supply chain managers navigating geographic challenges and port dependencies. These roles command premium compensation in coastal markets, reflecting both living costs and specialized expertise requirements.

Executive hiring emphasizes strategic sophistication. Regional leaders for multi-state territories. Plant directors for specialized facilities where quality and customization justify premium pricing. Commercial executives who manage relationships with architectural firms, engineering consultancies, and institutional owners.

The West rewards margin over volume, quality over scale, and strategic selectivity over market share gains. For candidates with sophisticated capabilities and specialized skills, it offers opportunities distinguished by technical complexity and compensation reflecting both.

Target Seattle (commercial and infrastructure), Denver (balanced growth), Phoenix (selected commercial), Bay Area (institutional and tech-driven construction), Los Angeles (large commercial), and Vancouver (high-density development).

The Mid-Career Bottleneck Nobody's Solving

Every hiring trend analysis points to the same conclusion: mid-career supervisory and technical roles represent the most acute shortage across North American manufacturing and distribution.

These positions require 5-15 years of experience blending technical knowledge with leadership or customer-facing responsibility. You can't promote entry-level workers into them quickly. You can't easily transfer talent from other industries. You can't justify executive-level recruiting investment. The result: persistent shortages, wage pressure, and companies competing aggressively for limited talent pools.

In building materials, this manifests as:

- Production supervisors who can manage plant operations, workforce scheduling, and quality standards

- Territory sales managers who understand products, relationships, and construction workflows

- Maintenance technicians with specialized skills and long learning curves

- Supply chain coordinators balancing inventory, shipments, and complex logistics

- Estimators and project managers in commercial distribution requiring technical specification knowledge

Hays' 2026 Salary & Hiring Trends Guide and manufacturing workforce analyses consistently identify these roles as hardest to fill. They're too experienced for quick internal development, too specialized for easy external hiring.

For job seekers with 5-15 years of building materials experience: recognize your market position. You're scarce. Employers know it. Compensation, advancement speed, and career leverage reflect that reality. Don't undervalue specialized knowledge such as the ability to run specific production processes, manage particular product sales, or troubleshoot complex equipment isn't easily replaceable.

Consider geographic mobility strategically. The same skills face different supply-demand dynamics across regions. A production supervisor in a saturated market might see limited advancement, while identical skills in growth regions create fast-tracked paths to plant management.

How to Actually Use This Map

Information without application is trivia. Here's how to translate regional patterns into strategy:

Match career level to regional hotspots. Entry-level? Prioritize the U.S. South and Mexico for volume and employer training investment. Mid-career with experience? You're in the tightest market everywhere—focus on roles where your expertise translates directly and consider geographic mobility for faster advancement. Executive level? Assess whether your background aligns with growth markets seeking expansion leadership or mature markets seeking operational excellence.

Target building materials companies, not construction firms. The industry comprises manufacturers (windows, insulation, roofing, HVAC equipment), distributors (ABC Supply, Builders FirstSource, regional dealers), and fabricators—not general contractors or builders. Use industry-specific job boards, association directories (NBMDA, NLBMDA), and LinkedIn searches filtered by company type and product category.

Validate demand with public data. Don't rely solely on this analysis. Check manufacturing and construction outlook reports from Deloitte and industry associations. Review salary guides from Hays and Robert Half for region-specific compensation and skills shortages. Monitor company announcements about plant openings and capacity expansions. Track job posting frequency and language around urgency.

Network within trade associations. Building materials remains relationship-driven. Product-specific associations, regional dealer groups, and manufacturing councils surface opportunities before public postings. Even virtual participation in webinars and LinkedIn groups builds visibility and knowledge.

Emphasize transferable skills with industry context. Transitioning from other manufacturing? Highlight process management, quality systems, and continuous improvement. From sales? Stress relationship management and territory development. Learn basic building materials terminology and product categories to demonstrate genuine interest beyond just finding any job.

The most valuable insight: building materials hiring in 2026 isn't uniform. Success depends on applying your skills in markets where they're valued, scarce, and compensated accordingly. Geography, career level, and product segment combine to create distinct opportunity landscapes.

The map is drawn. Whether you use it determines whether it's useful or merely interesting.

Frequently Asked Questions

Which building materials careers are most in demand for 2026?

Mid-career supervisory and technical positions show strongest demand: production supervisors, territory sales managers, maintenance technicians, supply chain coordinators, and estimators. These require 5-15 years of experience blending technical knowledge with leadership—expertise that can't be quickly developed. Entry-level production, warehouse, and inside sales roles remain in continuous demand, particularly in the U.S. South and Mexico.

Which regions are hiring the most building materials talent?

The U.S. South leads hiring volume across all career levels, driven by population growth, construction activity, and industrial expansion. Mexico shows very strong hiring in production and mid-career manufacturing tied to near-shoring. The Midwest and Central Canada maintain steady hiring with strength in mid-career and executive plant leadership. Northeast, Eastern Canada, and Western regions show more selective hiring in specialized technical roles.

Do I need a degree to work in building materials?

No. Production operators, warehouse workers, many sales support roles, and technical positions increasingly value technical school certifications and on-the-job training over four-year degrees. Many successful territory managers, branch managers, and plant supervisors advanced through internal promotion after starting entry-level and developing product knowledge over years. Current labor shortages have led employers to reduce degree requirements and invest in training for motivated candidates.

What are the best paying jobs in building materials?

Executive positions in operations, sales, and supply chain leadership command highest compensation ($150,000-250,000+ total comp in major markets). Technical sales for complex building systems in commercial markets offer strong mid-career pay, particularly in Western and Northeastern regions. Plant managers and operations directors earn competitive packages with performance bonuses. Specialized roles in quality engineering, process optimization, and supply chain management command premium pay. Compensation varies significantly by region—West Coast and major metros pay 20-40% premiums over interior and Southern markets.

How can I find building materials employers hiring in my region?

Use trade association directories (NLBMDA, NBMDA, product-specific groups) listing member companies by region. Search LinkedIn filtering for companies in manufacturing or wholesale distribution of building products. Monitor company websites for major employers like ABC Supply and Builders FirstSource. Attend industry trade shows and regional association meetings. Contact specialized building materials recruiters. Use salary guides and hiring trend reports to identify expanding companies.

How stable are building materials jobs during economic slowdowns?

Moderately cyclical—more stable than new construction trades, less stable than essential services. Manufacturing and distribution reduce hours but rarely eliminate facilities given restart costs. Companies prioritize retaining skilled workers and supervisors due to replacement difficulty. Segments serving renovation, repair, and institutional construction show greater stability than new residential-dependent categories. Executive and mid-career technical roles prove more stable than entry-level. Overall, building materials offers moderate job security with better stability than pure construction but more exposure to cycles than industries serving ongoing consumption.

The Territory Exists. Use the Map.

The building materials industry will hire extensively in 2026. Across all regions, though not equally. At all career levels, though not uniformly.

For candidates with the right skills in the right markets, opportunities exist in meaningful volume with compensation reflecting scarcity. For candidates in mismatched markets or career stages, success requires strategy: geographic mobility, skills development, industry networking, or patient accumulation of experience that makes you competitive.

The most valuable insight isn't which region hires most or which career level is tightest. It's that building materials remains fundamentally a people business—people making physical products, moving materials, building relationships, managing complex operations.

The map above charts where opportunities concentrate in 2026. What you do with that knowledge determines whether it becomes useful or remains merely interesting.